MARKET MAKING EXPLANATION

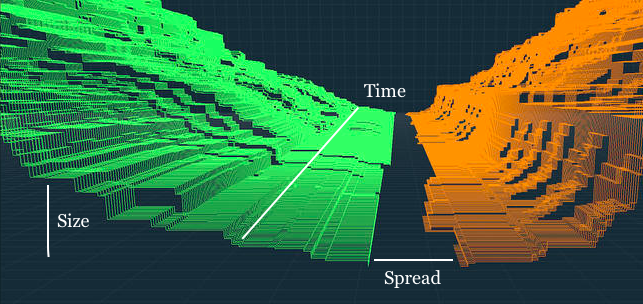

Market making is that the quoting of both a buy- and a sell-price during a financial instrument held in inventory, within the hope of creating a profit on the bid-ask spread. In Market making, transactions are events, positions in space and time. Every trade requires a buyer and a seller, ergo a buyer and seller of an equivalent instrument occupying an equivalent position in space and time. Many instruments exist and there are many spaces and times. the probabilities of someone willing to shop for a sheep and somebody else selling it on Regent Street at midday (prime sheeping time) are low. Markets (economics) attempt to solve this problem by providing an area , sometimes physical though more often abstract, where parties can transact. Thus, markets put parties curious about exchanging similar things in similar places to extend the probability of a transaction. This still leaves the matter of your time – the customer wants to shop for that sheep at midday but the vendor can’t get into Regent Street until 2 Ppm. An enlightened individual seeing that buyer sheepless every morning and noticing the abundance of sheep within the afternoon would note that he could be ready to sell the customer a sheep for a touch quite the gentleman later within the day would charge him. Of course, this is able to involve carrying a listing of sheep. But supposing there are enough buyers and sellers and therefore the prices of sheep aren’t changing an excessive amount of it’s reasonable to assume the danger of the inventory dying in exchange for the spread. Market making is that the process by which broker-dealers offer liquidity during a particular market. Broker dealers take the danger and pledge to carry a specific number of shares during a security. The market makers show their quotes and compete among themselves for the customers’ orders. Market makers are required to “make a market” which suggests buy and sell the actual security during which they’re market makers. However, they’re not required to shop for and sell at particular prices. In order to be ready to perform their duties, market makers got to hold inventory of the actual security. Market Making and Flow Trading requires competition for the flow of orders from their clients by displaying buy and sell quotations for a guaranteed number of shares. The difference between the worth at which a market maker is willing to shop for , and therefore the price at which the firm is willing to sell it’s called the Spread. This spread represents the potential profit a Market Maker can receive on each trade (both the buy and sell side added together). Once an order is received, the market maker immediately sells from their own inventory or offsets the order with another firm. Market Makers play a crucial role within the financial markets, acting as catalysts for daily trading and enhancing the liquidity of equities across the market. However, making money from the differences in bid and ask prices isn’t the sole function of market makers. Within their firm, the most priority is to supply liquidity to the firms’ clients, receiving a commission for every trade.

IMPORTANCE OF MARKET MAKING

Having designated market makers on exchanges is more important than ever as market structure continues to change.

Bats Global Markets received approval for its new market maker program, which uses a rewards-based system to incentivize market makers to make tighter quoted spreads with increased liquidity for each listing on Bats. Its Competitive Liquidity Provider program will particularly benefit small- and mid-cap companies who may have a lack of liquidity of their stock, which can make attracting larger investors difficult.

The CLP program will be used on Bats’ primary listings service. U.S. regulators last year gave approval for Bats to start listing shares, allowing the Kansas City-based trading platform to compete directly with the other exchanges offering listings, NYSE Euronext and Nasdaq OMX. It will look to attract listings away from its rivals by offering lower fees.

Market making has been going through a rebirth in light of fragmentation and from the May 6 flash crash. “On ‘the street,’ there’s a lot of talk that market makers really do provide a lot of value, as they have democratized the liquidity provision process,” Bryan Harkins, chief operating officer of Direct Edge told Markets Media. “Market makers can improve market quality. Launching market making on Direct Edge and working with our partners is the first step to improve overall market quality.”

Direct Edge launched its market maker program on Jan. 17, which it said will help to boost liquidity and improve market quality for participants.

Market makers are market participants that are obligated to quote a buy and sell price for a particular financial instrument, in the goal of making a profit on the bid-ask spread. In exchange, the trading venue usually grants the market maker informational and trade execution advantages. Some venues allow market makers to engage in naked short selling of a stock, or selling it without borrowing it. Historically, on the New York Stock Exchange and the American Stock Exchange, market makers were referred to as “specialists.”

Market making becoming increasingly important for the markets as trading volume is on the decline and as liquidity has been showing signs of drying up. Following the flash crash, the authorities proposed tighter regulations for market makers, in part to ensure that they continue to provide useful liquidity in times of market stress. Among the discussions are incentives that can be provided to the designated market makers. Profit margins for market makers have been declining amid a proliferation of high-frequency trading and the resulting reduction of the bid-ask spread.